My 2025 Higher Ed Finance Reading List

Robert Kelchen

JANUARY 2, 2025

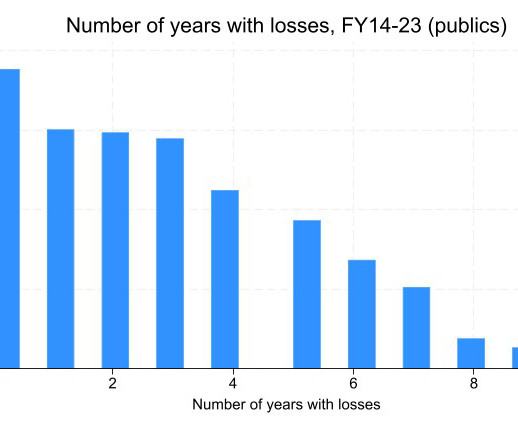

To add to the excitement of the coming few months, I have the pleasure of teaching my PhD class in higher education finance again. I use articles, working papers, news coverage, and other online resources to provide a current look at the state of higher education finance. Understanding budgets. Happy reading! Dans & S.

Let's personalize your content